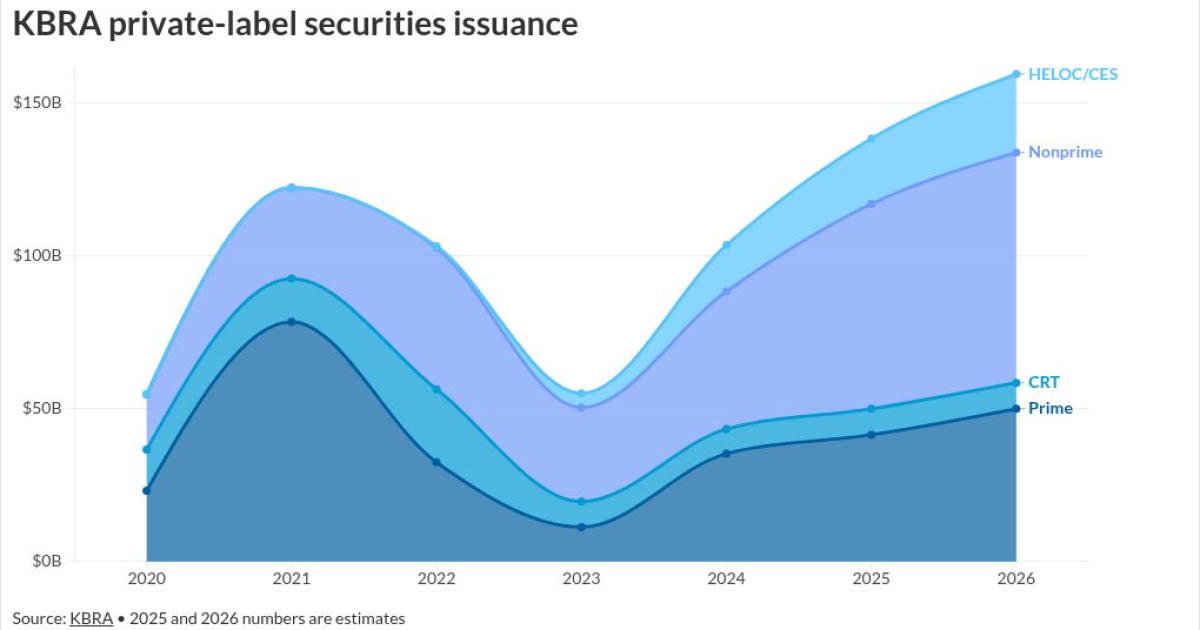

Non-qualified mortgages have been driving private-label securities in recent years, representing nearly half of the market in 2025, and they and other PLS loan types are poised for further growth going into 2026.

This part of the residential mortgage-backed securities market has been on track to break a record in 2025 with a $66.95 billion worth of issuance forecast for this year, according to Kroll Bond Rating Agency. That number could jump another 12% next year to $75.25 billion.

The smaller

Closed-end second volume has dominated loan activity in this part of the market with fewer deals in the home equity line of credit sector, Armine Karajyan, senior director for residential mortgage-backed securities, said during a KBRA press conference on the 2026 outlook.

"In total, we're looking at $160 billion of RMBS 2.0," Karajyan said, noting that this would make 2026 the highest year for new private-label securities issuance since the global financial crisis.

Perspective on risks flagged in private RMBS outlooks

Moody's Ratings "expects the collateral performance of residential mortgage-backed securities will continue to deteriorate in 2026, driven by a weaker labor market, elevated borrowing costs and affordability challenges."

Risk factors for non-QM include its alternative underwriting, which can result in limited documentation or income verification and delinquency rates higher than in other residential securitizations, according to Morningstar DBRS. High credit scores and reserves offset these things.

Home equity risks to watch include closed and open-end second-lien programs with alternative documentation. Morningstar DBRS also flagged nonbank home-equity lines of credit that have features that could lead to payment shock, noting that delinquencies have been rising but "charge-offs and losses remain minimal."

Reverse mortgage sponsors and servicers are becoming "less diversified as businesses" and their loans face home price risks, the rating agency's analysts wrote, while noting that low loan-to-value ratios help manage the latter.

Although many 2026 forecasts predict consumer strain and

While

"That is what's going to drive still tighter credit performance across the board," Pratik Gupta, head of residential mortgage-backed securities and collateralized loan obligations, said during Bank of America's online press conference.

RMBS ratings have been largely stable in recent years, suggesting analysts have done a better job calibrating how much protection securitization structures need to guard against performance risk. That stands in sharp contrast to the miscalculations exposed during the housing price collapse of the financial crisis.

Some areas may be particularly prone to price softness

There are some nuances and wild cards in this home price appreciation forecast that could affect PLS as well as the broader mortgage market next year.

While home equity levels are still historically high overall, the housing market's softness is on track to be more pronounced in certain areas, said Chris Flanagan, head of U.S. mortgage and structured finance research at Bank of America.

"We are looking for basically flat, maybe up 1% or so on home prices, but here the story that's very important is there'll be significant regional variations," Flanagan said.

"There's just excess supply in those markets that needs to be absorbed, and a way that it will get absorbed, in our opinion, is by virtue of price declines," said Flanagan.

Securitizers that wish to manage this risk may include such loans in collateral pools with a broader range of geographic areas.

The housing market has been overvalued since mid-2020 and a correction in certain markets could normalize prices, according to Fitch Ratings.

"While asset bubbles remain rare, specific pockets of rapid credit expansion and promises of transformative market paradigms merit higher vigilance," Fitch analysts said in a recent outlook report.

This may be a particular concern for the jumbo sector, offset by low loan-to-value ratios and what are typically high borrower reserves, according to Morningstar DBRS.

"Higher cost geographies are more susceptible to the risk of home price declines," analysts wrote in their forecast.

A 'refi bump' is in the rate forecast for 2026

The larger mortgage market could experience a mild uptick in refinancing with stable to lower rates next year that could lead to limited prepayments in private-label securities.

"We do not expect a refi wave. We may be expecting to see some increased activity, maybe a bump, per se, but nothing extraordinary on that front," KBRA's Karajyan said.

Typically a downward move on mortgage rates could lead some borrowers to choose cash-out refinances over junior lien alternatives but the risk of this is limited, according to researchers at Bank of America Securities.

"If the first lien rate is high, it makes sense to consolidate the second lien into a cashout. The majority of second lien holders typically have a very low first lien mortgage, and they're very far away from that possibility," said Jeana Curro, head of agency MBS research.

Change at Fannie and Freddie could impact PLS

Another ramification of lower rates is that they could tilt the playing field more toward the government-related agencies that dominate the securitized market, according to Bank of America Securities researchers.

"As rates come down, they're going to be more competitive," Curro said. "We think their issuance volume is going to increase as well."

The GSEs also could increasingly be more interested in buying agency MBS, Curro noted in a

Morningstar DBRS forecasts that the enterprises'

If the government-sponsored agencies exit conservatorship, some expect

Some stock analysts have been increasingly bullish in regard to the government-sponsored enterprises' prospects for taking steps away from government ownership.

While several obstacles to bringing the GSEs out of conservatorship remain, Wedbush's Henry Coffey sees much more of a willingness for government officials to act in line with the many housing goals they have, which include increasing competition for home financing.

"They want Fannie and Freddie out of conservatorship. They want them back as vibrant public companies, which they can be. They want a competitive mortgage market," Coffey said.