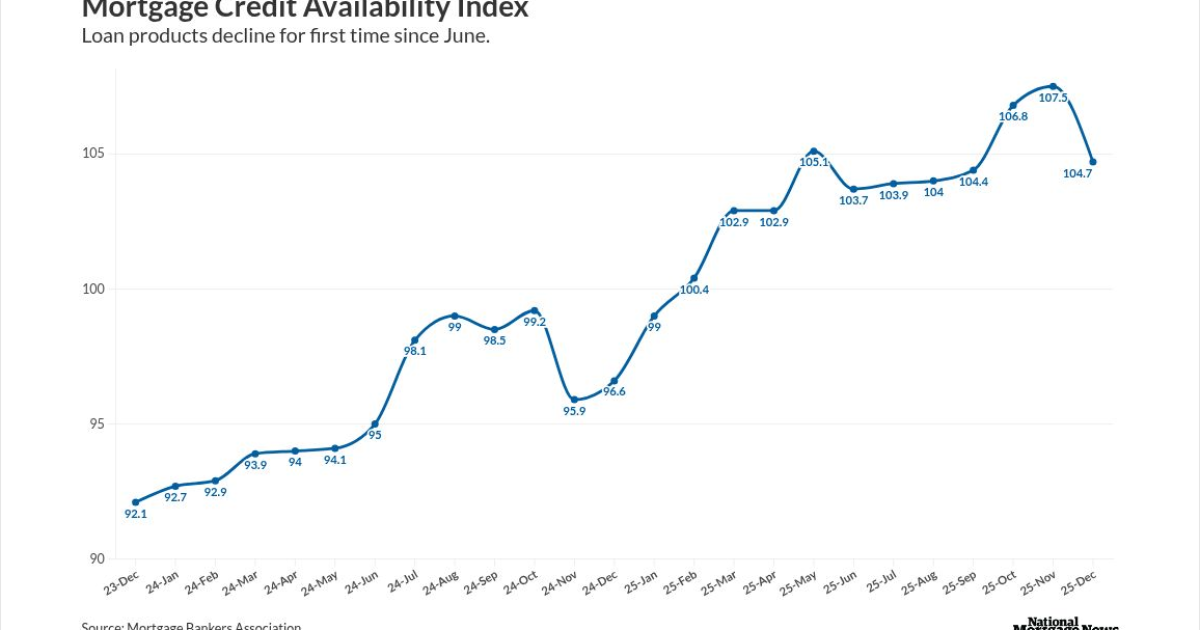

Loan credit availability increased from a year earlier but finished 2025 at its tightest in three months, as conforming products in particular took a notable dive, according to the Mortgage Bankers Association.

Across-the-board pullbacks, led the MBA's mortgage credit availability index to drop 2.6% in December to a reading of 104.7

December's data also showed the index declining for the first time since June. Recent growth in credit had been buoyed by an influx of adjustable-rate and refinance loans in 2025.

Despite the end-of-year dip, the index still ended the year surging 8.4% from a score of 96.6 in December 2024. A drop in the MCAI indicates tightening credit conditions, with a benchmark of 100 reflecting availability in 2012 immediately following the Great Financial Crisis.

"Mortgage credit availability increased on an annual basis in December due to increased loan program offerings and industry capacity compared to the end of 2024. However, on a monthly basis, credit supply declined to its lowest level in three months, with tightening in both conventional and government loan offerings," explained Joel Kan, MBA's vice president and deputy chief economist, in a press release

"The December decrease reversed gains from the prior two months, driven by a reduction in loan programs, including ARM loans and cash-out refinances, along with a tightening in documentation requirements," Kan further said.

With the exception of January, the MCAI came in above 100 for each month of 2025.

Conforming credit hits a new low

Both components that make up MBA's conventional index contributed to its December slide of 3.6%. Jumbo availability fell by the same 3.6% margin, while the conforming subindex took a 3.8% drop to land at its lowest level

One month earlier, conventional loan availability had increased by 1.1% thanks to an uptick in jumbo credit.

Meanwhile, the government MCAI, which tracks availability of lending through federal programs, moved down 1.4% month over month after pulling in flat in November.

A slow but sustained

How mortgage locks fared

As credit contracted to end 2025, lock volume similarly took a steeper-than-expected monthly decline, according to a new report from Mortgage Capital Trading. MCT attributed slowing to residual uncertainty following the recent government shutdown as well as mortgage rate levels remaining above 6%.

"When you combine typical winter seasonality with the spillover effects of the longest government shutdown in history, it makes sense that people became more conservative about making big financial decisions, including buying a home," said Andrew Rhodes, head of trading at MCT.

Total lock volume fell 18.7% in December, with both purchases and rate-and-term refinances retreating between 19% and 19.5% from the previous month. Cash-outs took a smaller drop of 13.7%.

Despite downwardly trending December data, lock activity was higher across all categories on a year-over-year basis, according to MCT.