Mortgage rate-lock activity ended the year on a strong note in spite of seasonal trends, new industry data found.

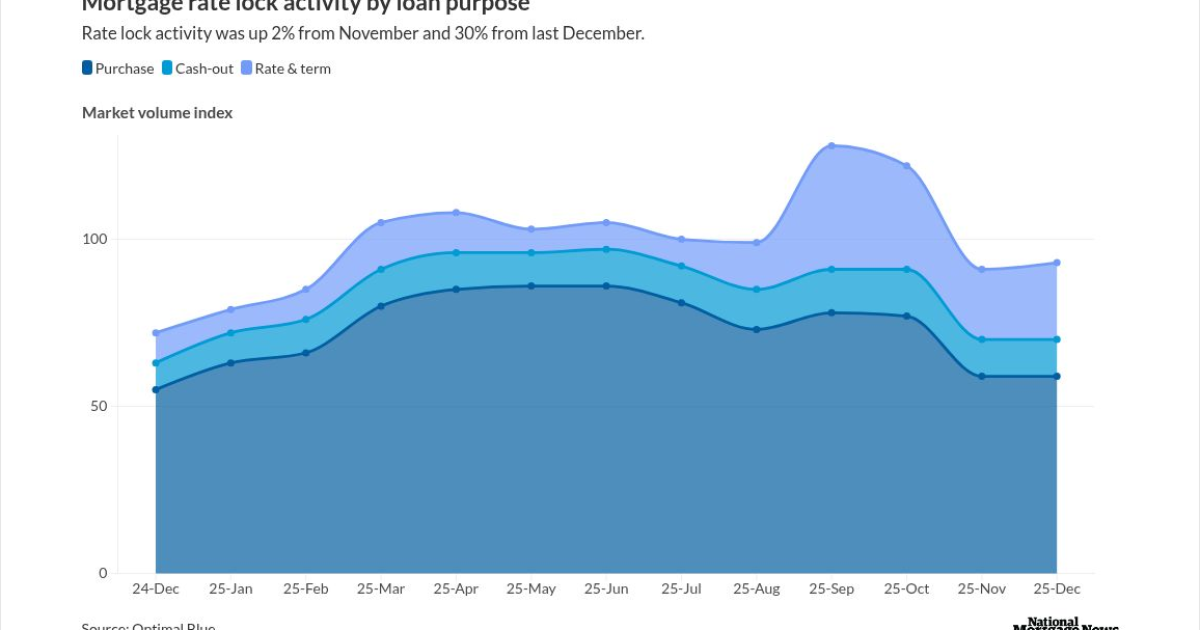

Optimal Blue's latest Market Advantage report showed total lock volume increased 2% from November and finished 30% higher than last December. The boost was driven primarily by rate-and-term refinances, which rose 13% on a monthly basis and more than 170% year over year.

Cash-out refinance increased by just 1% month over month, while purchase activity dropped 1% from November. But each were up 35% and 7%, respectively, from the year prior.

"Finishing the year with higher lock volume in December is a clear signal that borrower demand has adjusted to today's rate environment," said Mike Vough, senior vice president of corporate strategy at Optimal Blue, in a press release Tuesday. "Refinance activity continues to do the heavy lifting, but the fact that purchase volume held essentially flat month over month and finished the year higher than last December speaks to a market that is more durable than many expected."

Mortgage rates

Heading into December, rate locks

Refinances accounted for 37% of all locks in December, up 2.24 percentage points from November. Non-qualified mortgage production finished December above 9% of locks, up 50 basis points, while conforming loans accounted for 51% of locks, down 86 basis points, according to the report.

Lenders also made adjustments on the secondary side as pricing dynamics and execution strategies evolved, Optimal Blue said.

"December's secondary data shows lenders actively recalibrating execution as spreads widened and pricing discipline remained tight," Vough said. "The shift back toward bulk aggregation, combined with stable top-tier pricing and rising MSR values, reflects investor demand that is focused on end-of-year balance sheet management and long-term value as we head into 2026."

New home sales

New home sales followed Optimal Blue's purchase activity trend,

Sales of new single-family houses in October 2025 were at a seasonally-adjusted annual rate of 737,000, 0.1% below September's rate but still 18.7% above the previous year, the report estimated.

"Following a shutdown-related delay, new‑home sales beat expectations in October," First American Senior Economist Sam Williamson said. "After downward revisions to August, the September–October period now marks the strongest two‑month stretch since early 2022, as easing mortgage rates — paired with builder incentives and price flexibility — continued to draw buyers back into the market."