Insurance-in-force growth at the government-run Federal Housing Administration will continue to outpace its private counterparts going forward because of the current state of the housing market, a Keefe, Bruyette & Woods report said.

The market share (based on IIF) split between the two products has been narrowing since the third quarter of 2022. At that time, the private mortgage insurers held a 55.1% share. In the three years since, this has slipped 500 basis points, so while they still hold more IIF than FHA, it is now just 50.1%, or almost equal.

KBW had a caveat on the FHA data, that the Department of Housing and Urban Development had not released a monthly production report since June, so the third quarter data is from the fiscal year 2025 annual report.

For the last fiscal year, this report noted FHA's

"We anticipate FHA growth to continue outpacing the growth of PMIs in a higher-for-longer environment as FHA volume continues to benefit from affordability-related factors and GSE-to-FHA cash-out refinance debt consolidation volume," the analysis authored by Bose George said.

After

In the latest commentary, IIF increased for all forms of mortgage insurance by

But private mortgage insurer IIF only rose by 0.9% quarter-to-quarter, while FHA grew by 2.4%. On an annual basis, these companies had a 1.9% IIF increase, versus the 9.7% gain for the government program.

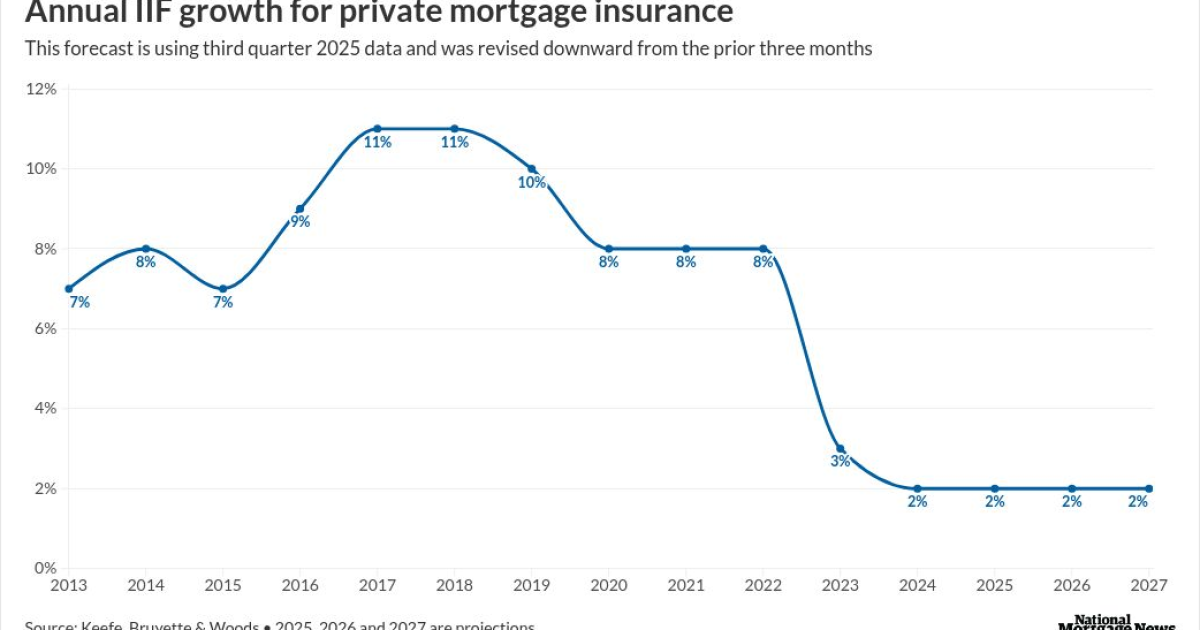

For the period between 2025 and 2027, George is predicting 2% annual growth for each year in insurance-in-force (fourth quarter 2025 data for the private companies has yet to be released).

But the expected growth rate compares with an actual 8.1% for 2022, although this dropped to 2.9% for 2023 and 1.9% for 2024.

It is also a change from the second quarter KBW report, where George modeled 3% growth for mortgage insurer IIF in both 2026 and 2027.

In a July report, George noted he was