Even though Keefe, Bruyette & Woods has downgraded the stock rating on three of the five private mortgage insurers it covers, its analysts are still relatively bullish on the segment.

Radian, Essent and NMI Holdings have all been dropped to a market perform rating from outperform in large measure because of

The move equalizes these companies' ratings with those already on MGIC and Enact. The analysts do not cover the sixth company currently underwriting private mortgage insurance, Arch Capital Group.

"We expect the sector to generate above-normal [returns on equity] again in 2Q, driven by reserve releases as credit performance should benefit from steady employment and embedded home price appreciation," George wrote.

But referring to the not-so-positive catalysts which could impact the MIs, "looking into the back half of the year, we think credit risk could increase modestly as the pace of

The analysts are also concerned that

While the report did not mention recent changes to the Federal Housing Administration program designed to bring down the cost of the government-run MI program and make it more attractive for lenders and consumers,

KBW is modeling a normalization of credit trends through 2027. It also expects insurance-in-force growth rates to remain slow.

For the just-ended second quarter, when the MIs report earnings in the coming weeks, KBW is forecasting ROEs of between 12.5% and 16% due to those reserve releases; MIs, like other insurers, set aside reserves to cover future losses, but can recapture some of those

This should help with the expected

Seasonality, given that the second quarter covers much of the spring homebuying season, should drive up new insurance written volume compared with the first quarter, but the increase should be "fairly subdued," George said.

"We are modeling roughly flat premium margins Q/Q which is consistent with management commentary at the time of earnings and since quarter end," the report noted.

In the first quarter earnings commentary from industry participants, the management teams said they were seeing "constructive and rational pricing trends," which has been the case when they were speaking at industry conferences during the period.

Prior to the industry-wide adoption of so-called "black box pricing" algorithms, mortgage insurers would use discounted pricing as a way to increase market share.

While

Black box pricing has also narrowed the gap between industry participants. In 2018, market share as measured by NIW ranged from National MI's 9.4% to Arch's 23.8%, according to data from KBW. For the first quarter, all six companies were between 15.9% (National MI and Arch) and 17.6% for MGIC.

On the loss side, KBW is still forecasting relatively low loss ratios compared with historical averages.

"Our forecasts call for a slight uptick in new delinquent notices in 2Q25 compared to 1Q25, which leads to our core loss ratios increasing across our coverage," George said "This is being driven by a combination of portfolio seasoning and seasonality."

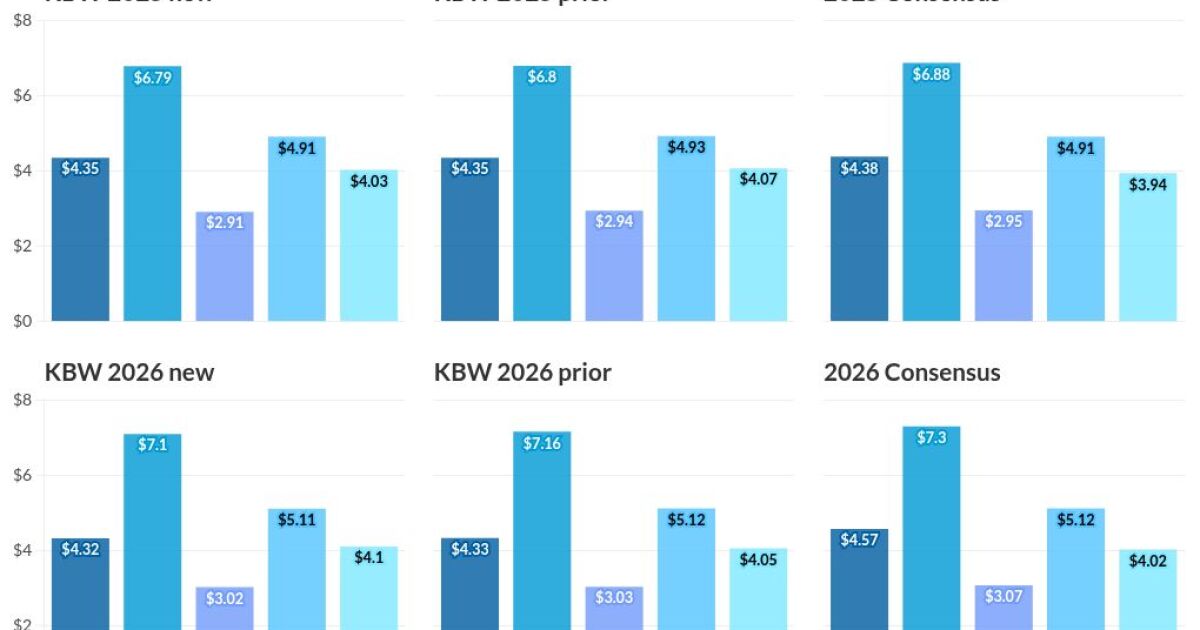

KBW did reduce its earnings per share estimates for this year and next, with two exceptions, but termed its changes as "modest…but nothing material."

Any differences versus the consensus is because of differences in how reserve releases are modeled because they are difficult to forecast.

KBW kept Enact's 2025 forecast at $4.35 per share. It also increased Radian's 2026 outlook by 5 cents per share to $4.10.