Federal Home Loan Bank members' borrowing as a share of total assets increased in stressed environments but the majority did not see excessive increases like Silvergate's, the Government Accountability Office found.

Former warehouse lender-turned-crypto specialist, Silvergate Bank, was an outlier in increasing its ratio 33% just before the 2023 crisis which led to its liquidation, the study suggests. Silvergate

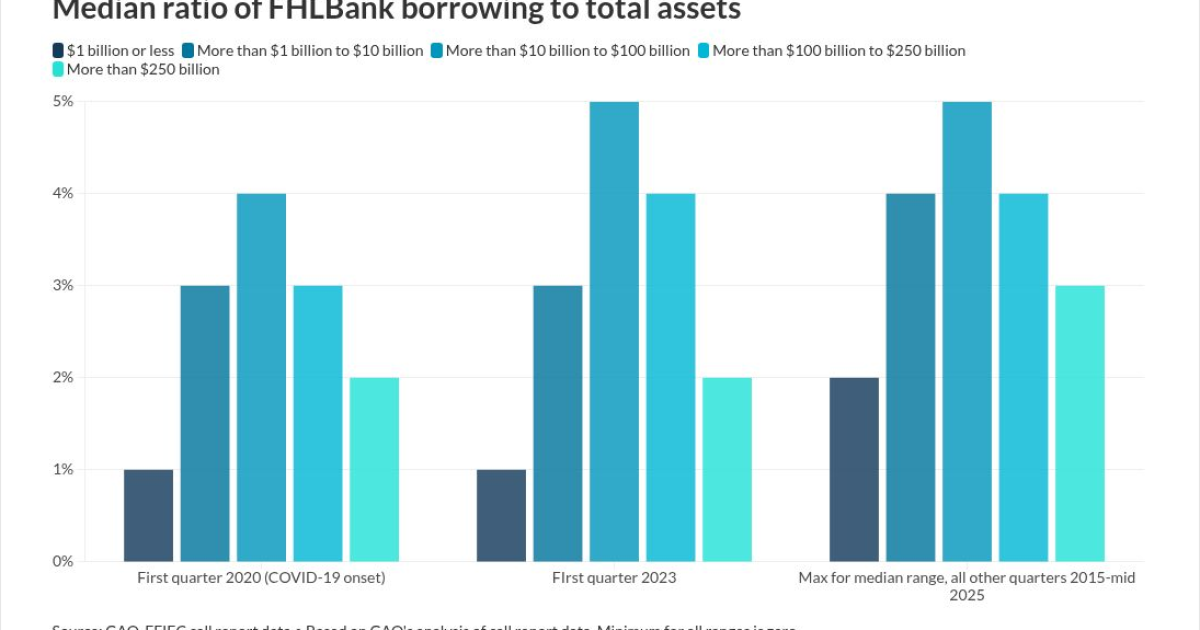

The majority or 76% of active members had borrowing ratios relative to total assets in 2023 and the pandemic that was 5% or less of total assets, according to the GAO, which noted that this is at the high end of the range seen outside of crisis periods between 2015 and mid 2025.

"This indicates that banks typically do not change their reliance on FHLBank borrowing significantly from one quarter to the next," the GAO said in the report on its analysis of call report data from the Federal Financial Institutions Examinations Council.

Member borrowing the system accommodates through an

"There have been voices in the public domain that have suggested that increased Home Loan Bank borrowing is somehow a sign of weakness, but I think this report strongly suggests that it is a sign of strength," said Ryan Donovan, president of the Council of FHLbanks.

Exceptions beyond Silvergate, max ratios by asset size

Besides Silvergate, five other banks' ratios jumped over 10 percentage points either at the end of 2022 or in first-quarter 2023, the GAO noted. That means less than 1% of members experienced unusual borrowing relative to total assets given the FHLBanks' membership of around 6,500 in 2023. Borrowing rates for all the other banks decreased immediately after the first quarter 2023 crisis, according to the GAO.

The GAO also broke down ratios by size tier and found the majority of FHLBank members' increases were range-bound for each.

The upper-end maximums for the median range in non-crisis periods were as follows: banks with more than $10 billion but no more than $100 billion in assets, 5%; and over $1 billion-$10 billion and in excess of $100 billion-plus to $250 billion, 4%. Lower maximum ratios were found in the following ranges: banks with over $250 billion in assets, 3%; and institutions with $1 billion or less in assets, 2%.

Banks of over $10 billion in assets have dominated borrowing, the report noted.

Potential risks in proposed pricing reforms

The study also examined other aspects of the system that have faced other types of scrutiny in the past and proposed reforms, including two pricing concepts, by gathering feedback from stakeholders.

The report examined two proposed pricing reforms. One calls for the system to price advances higher than the discount windows primary credit program rate. The other suggests pricing should be based on individual members' credit.

The first proposal would require the system's oversight agency, the Federal Housing Finance Agency, to engage in rulemaking.The GAO noted that some stakeholders indicated it could include

"FHLBank representatives and FDIC officials also cautioned that artificially raising net advance rates higher than the discount window could create market distortions," the GAO added.

In reviewing potential for lending based on individual credit, the study noted this is already considered in existing policy and risk management mechanisms, like haircuts or reduction in advances.

The GAO also noted that it received shareholder feedback suggesting that "pricing based on members' credit risk could disadvantage small banks, which may appear riskier due to their asset size."

When asked about the report's bearing on potential reform, Donovan said that it could "come through as some sort of policy change" but noted it would likely be one that surfaces gradually.

"Right now, I think when I look at this report, I see this as validation of the work we're doing," he said.