Affordability continues to improve in 2026, with home-price growth flattening and

Early January declines in rates helped push affordability to a four-year high, as the monthly principal and interest payment needed to purchase the average-priced home dropped 7%, or $164, year over year to $2,091, reducing the share of median household income required to 27.8%, according to ICE Mortgage Technology's latest market monitor report.

"Even small reductions toward 6% rates can significantly boost affordability, particularly for homeowners who could refinance into a lower rate and monthly payments," said Andy Walden, head of mortgage and housing market research at ICE, in a press release Monday. "That said, affordability remains structurally challenged, with home prices still elevated relative to incomes and meaningful differences emerging across regions and borrower segments."

The 30-year fixed rate mortgage

Nearly 1.3 million borrowers recently originated mortgages that carry rates between 6.875% and 6.99%, including more than 500,000 from 2025, which made it the most common rate band last year and the most sensitive to interest rate shifts in the low 6% range, the release said.

While

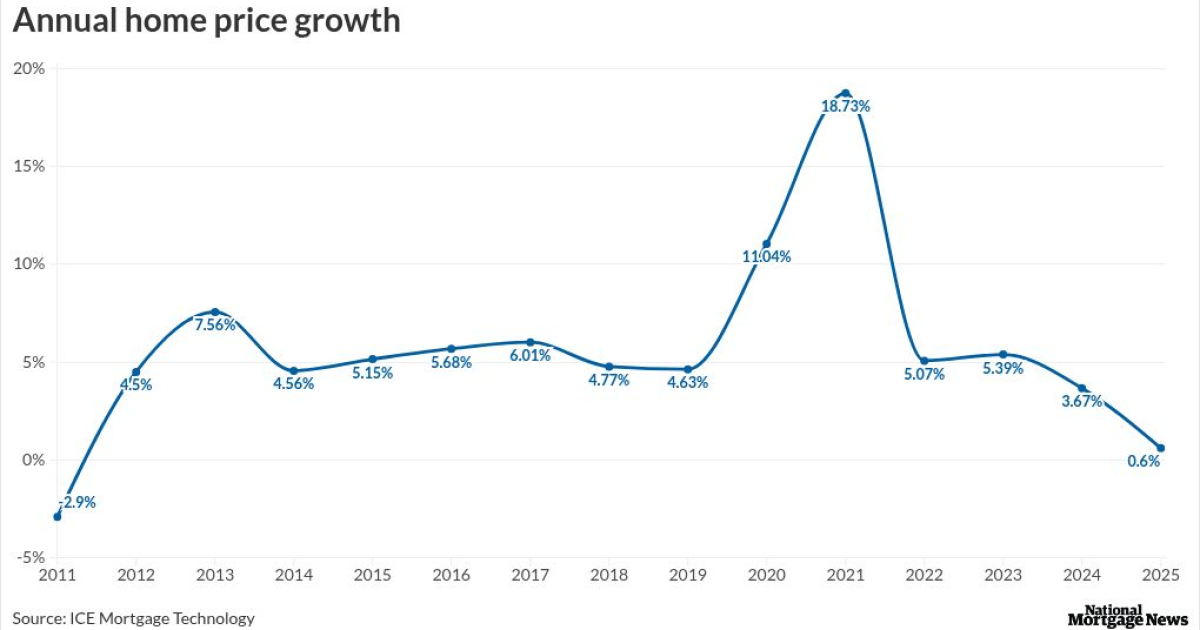

Home prices

But minimized price gains left many homeowners underwater last year. More than 1.1 million borrowers ended 2025 underwater, the most since early 2018, with negative equity prevalent among Federal Housing Administration and Department of Veterans Affairs loans originated in 2022 or later, the report showed.

Borrower equity reached a

Several Southern markets have more than one in 10 mortgaged homes underwater as well, ICE found.

"Today's market is full of cross‑currents — borrowers responding quickly to rate shifts, affordability improving for some but not others, and pockets of rising credit stress," ICE's President Bob Hart said in the release.