In

How did the residential mortgage industry arrive at such a strange juncture where four giant monopolies control US consumer credit data? And why is the cost of credit reports, still a tiny fraction of the $11,000-plus average cost of originating a residential mortgage, such a hot button issue?

Credit report costs, especially for mortgages, have significantly increased in cost over the last five years.

READ MORE:

But the highly concentrated structure of the credit reporting industry is also a big factor. Seventy-five years ago, the "Big Three" (Equifax, Experian, and TransUnion) did not exist. There was no centralized, national credit reporting system as exists today, but rather thousands of small, local, and regional credit bureaus operating across the United States.

In 1950, independent, locally owned cooperatives or small, private agencies tracked consumer credit behavior within specific towns or counties. They treated your personal credit data as their proprietary information and gathered quantitative and qualitative data on consumers in a way that would be intolerable today.

The monopoly power of the three credit bureaus and credit score agency Fair Isaac forces the consumer finance industry to accept price increases, although not without complaint. This is especially true because the FHFA mandates that lenders must "pull" reports from all three bureaus for conventional loans.

The

- To end the government-granted oligopoly that results in ever-increasing costs for borrowers and lenders with no commensurate increase in quality or service.

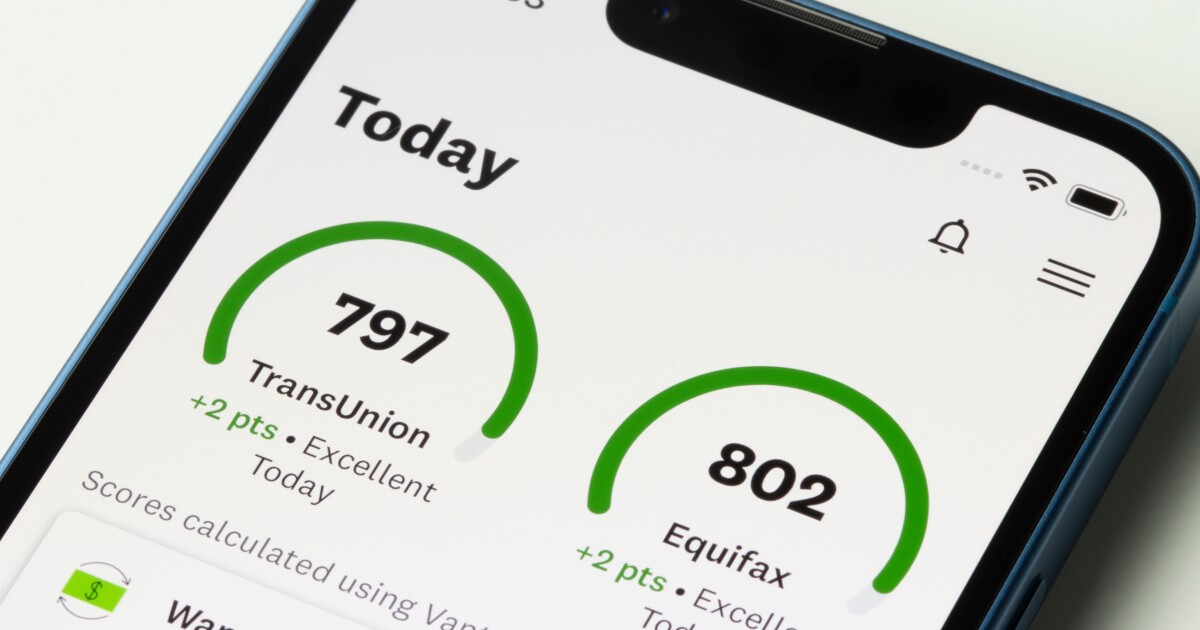

- To streamline the origination process and remove unnecessary cost. Fannie's average credit score is 757, and 75% of their loans have a score of 740 or higher. Why on earth are we still getting three credit reports and three scores?

- To create competition by ending the government mandate requiring three reports from the only three approved providers. That will spur innovation, service improvements, and more accurate credit reports, all at lower costs.

Several lender groups, however,

Differences in bureau data mean a single report could increase risk by leaving out information in the currently used tri-merge are a concern, according to the CHLA and other borrowers contacted by NMN.

"If I don't do a comprehensive pull on everybody and absorb that cost of the tri-merge," argues Sher, "then I could miss something, a customer walking away from a credit card, for example. Assuming that one of the three bureaus has it."

Sher also notes that each lender who talks to the same borrower bears the $150 cost of pulling a tri-merge report. "The consumer should only need to pay for a credit pull once," argues Sher, who argues that there is not yet a consensus within the MBA membership for any change.

For borrowers with less than perfect credit, the lender may be compelled to pull all three credit reports and absorb the cost. Sher and others believe that the solution to the cost escalation by the credit bureaus and FICO is to make a fundamental change in the industry by giving consumers ownership of their personal data.

The Consumer Financial Protection Bureau

In July 2025,

While NMN spoke with a number of lenders in preparing this comment, most asked not to be quoted by name, part of the industry's well-known reluctance to speak out of fear of retaliation by regulators or political leaders. But a number of chief executives told us that the key issue remains risk to the borrower, the GSEs and the lenders who miss a credit event.

"Dropping tri-merge is probably OK in today's market," notes Stan Middleman, founder and CEO of industry leader Freedom Mortgage. "Problem is that it could encourage credit shopping. Historically, there has been the potential for large discrepancies between agencies. Admittedly less so today."

Middleman worries that we are in the part of the cycle that has been susceptible to credit loosening to stimulate activity, but this is only one piece of a move to looser credit. "Because of constrained inventory the danger is not yet great," he adds. "Looser credit with larger inventory of homes for sale could be a very dangerous combination."