The effect of surging insurance costs over the past few years is raising alarms for many homeowners, with nearly half saying higher premiums are "seriously" influencing new purchase strategy.

Approximately 49% of homeowners said insurance costs factored in either "very heavily" or "seriously" behind purchase decisions, according to a recent survey from Kin. The

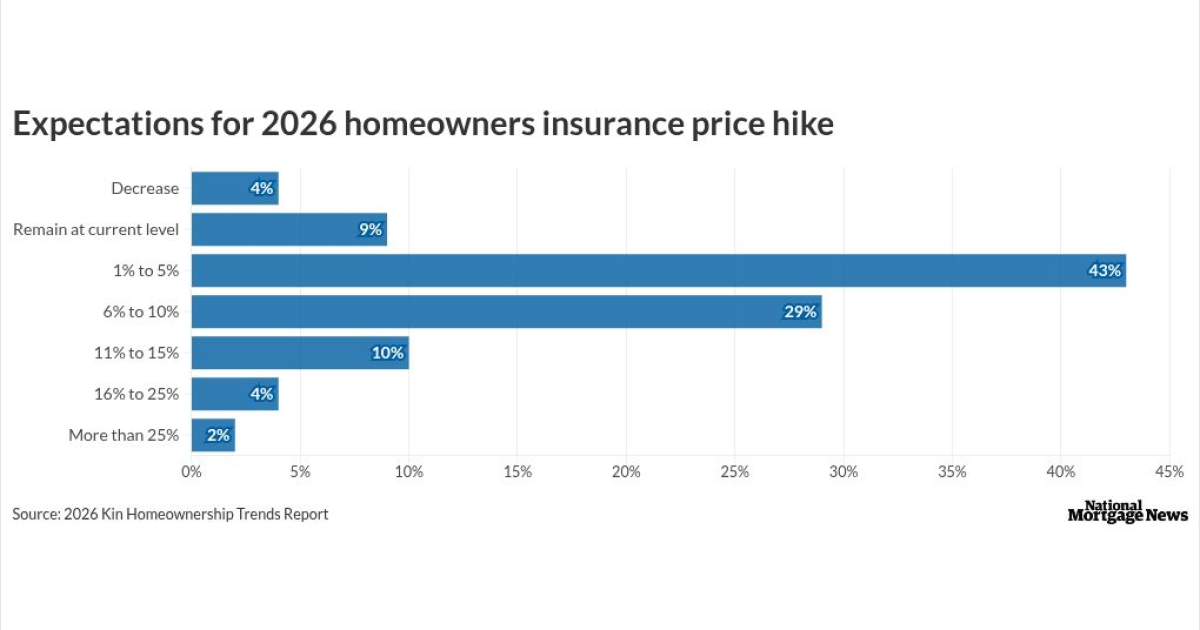

Between 2021 and 2024, premiums increased by 24%, more than double the 11% of inflation over the same time period, according to the Consumer Federation of America. A clear majority of homeowners surveyed expect premiums to further increase with 45% expecting hikes of at least 6%, Kin's research found.

Overall, 70% of the 1,000 homeowners in the survey acknowledged that insurance costs play a larger role in their decision-making than they did five years ago.

While premiums

"Substantial premium increases were the story in 2024, but they weren't the story in 2025 except for some places like California. And, they won't be the story in 2026," said the company's founder and CEO Sean Harper in a press release.

"Elevated inflation was one of the big drivers of premium increases last year, but inflation is now occurring at a more predictable pace," he said.

Although

What homeowners say about climate change

Going hand-in-hand alongside many homeowners' cost concerns is the effect of climate change on their properties. Weather events have played a role in "fundamentally changing where Americans choose to live and how they make financial decisions," Kin's research said.

An overwhelming 93% of respondents expect to see damage to their properties in the next three years from extreme weather,

Growing worries about a changing climate are also leading 49% of homeowners to consider moving altogether at some point in 2026 to escape any potential impacts. Among that share, a quarter suggested they may even relocate to another state.

In the subset considering relocation, Florida and California rank as the states they would most likely avoid, with shares of 58% and 52%, Kin said. Both have borne the brunt of accelerating insurance premiums this decade,

Other states landing near the top of the avoid list among hesitant movers were Hawaii, Louisiana, Texas and Alaska, all of which saw shares of at least 20%.