Black homeownership, which has consistently lagged behind that of other racial groups, has also dropped during the pandemic, so lenders and the Biden administration will need to go the extra mile if they want to fulfill promises to improve equitable access to housing.

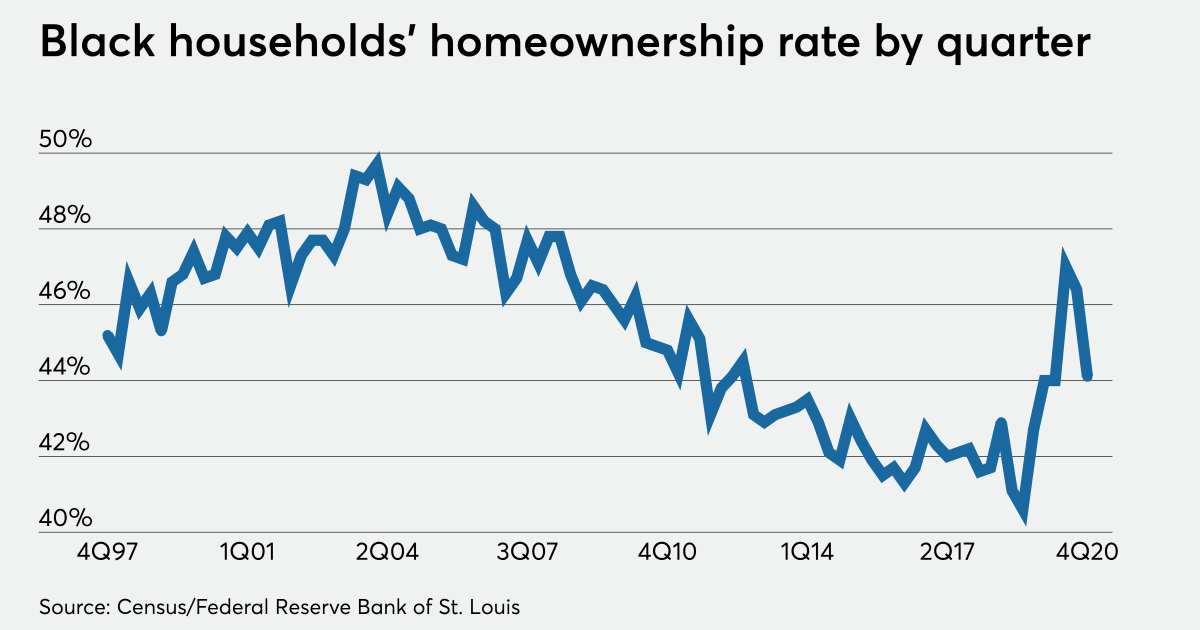

The homeownership rate for Black households was 44.1% in the fourth quarter, down from 46.4% in 3Q 2020, and virtually unchanged from both a year ago and when the Fair Housing Act outlawed discrimination in 1968. For years, it’s consistently been more than 20 percentage points lower than the average homeownership rate, and over 30 percentage points lower than the homeownership rates for whites.

With historic barriers including discrimination, wealth inequities and predatory lending to overcome, change may take time, but there are steps lenders can take now, industry leaders say.

“Since 2015 there have been approximately 1 million new Black homeowners. Unfortunately, the number of black applicants has not reached pre-2008 levels,” said Antoine Thompson, executive director of the National Association of Real Estate Brokers, the oldest minority trade group in the nation. “Marketing and outreach, diversity in loan officers and staff and mortgage underwriting criteria may play key roles in increasing Black homeownership.”

What follows are five steps mortgage companies can take to that end, distilled from information presented at NAREB’s annual meeting, the “Bridging the Gap in Black Homeownership” virtual event organized by New American Funding, and several other sources.