The nation's private mortgage insurers are adequately capitalized to deal with the housing market's challenges during 2026, so on balance they have a neutral outlook for next year, Fitch Ratings said.

"We expect strong borrower credit profiles, relatively stable employment levels, and persistent home price appreciation to help mitigate pressures from ongoing housing-affordability challenges," Fitch analysts Christopher Grimes, Tana Marcom and Laura Kaster wrote.

Fitch's outlook incorporates the impact of the potential stress of

"New business pricing has been stable, with conservative underwriting across the industry amid economic uncertainty," Fitch said.

All of the active firms are adopting black-box pricing, which has also

Meanwhile, Fitch expressed a small level of concern regarding default activity in 2026; mortgage insurers only pay out claims after the loan goes into foreclosure.

"Headline unemployment figures have not meaningfully risen, but the pace of recent hiring activity has been slowing,

Rising originations effect on MI

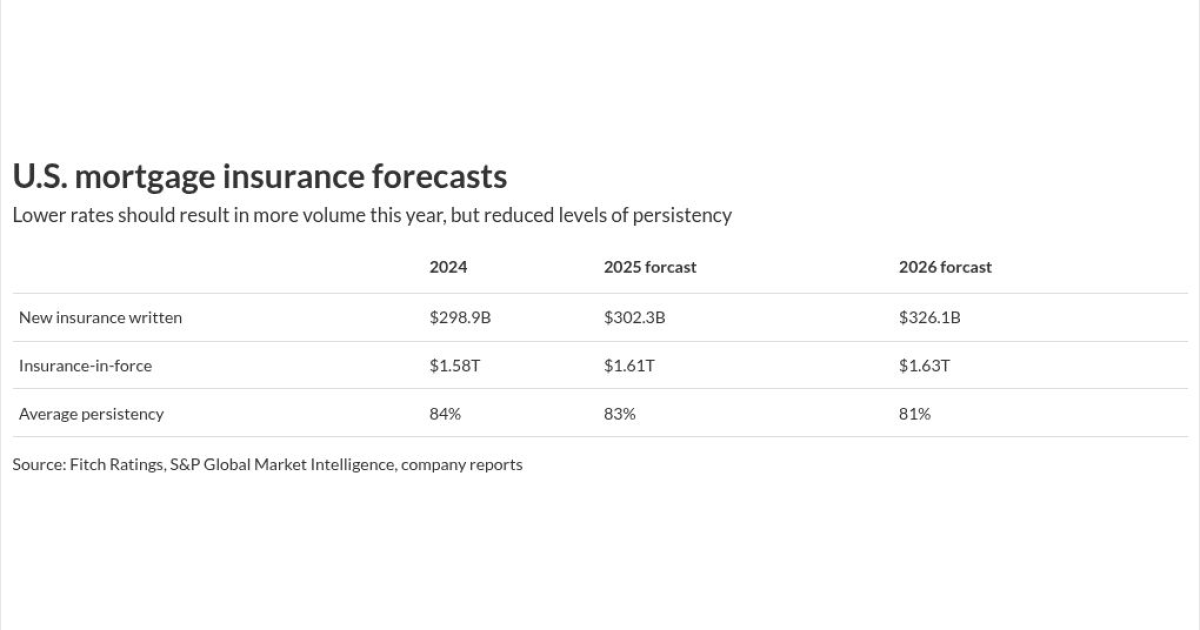

Mortgage originations are expected to increase this year, and this will benefit the mortgage insurers' new insurance written volume, Fitch said. Fannie Mae

But unlike title insurance, MI production is not correlated with total loan volume. Private MI is used in the conforming market only for originations with loan-to-value ratio over 80%. It is not needed for many non-qualified mortgages. Government-guarantee programs cover other loans.

"NIW credit quality has not deteriorated despite home-affordability challenges," the Fitch report added. "MI competitors in aggregate reported relatively stable delinquency levels in the third quarter, with the overall industry delinquency rate increasing to 2.15% from 1.98% year-over-year."

The increase is likely a result of normal portfolio seasoning and typical calendar-based seasonal loss activity, the analysts continued.

Just under half of the current insurance-in-force

Persistency, a measure of how much business remains on the books from 12 months' prior, is likely to come under pressure if rates decline further, resulting in higher portfolio turnover. Through Sept. 30, 2025, persistency averaged 84% over the prior 12 months.

"Fitch believes a disciplined approach to capital management, characterized by

The rating agency will continue to monitor merger and acquisition trends to expand beyond the core business, such as

"Additionally, the privatization of Fannie Mae and Freddie Mac could mean greater opportunities for private MIs, but also invite more regulatory and market uncertainty, requiring careful capital and risk management," Grimes, Marcom and Kaster wrote.

How the large title insurers will do in 2026

Earlier in December, Fitch also put out a title insurance outlook, which also is neutral, "reflecting expectations for stable profitability and ratings.

"Strong capital positions, modestly higher origination volumes, and continued expense management will support the sector's margins and ratings in the coming year," Fitch said.

Title loss ratios should remain at favorable levels, as the underwriters

"Risks to sector performance include a substantial increase in mortgage rates, tighter credit conditions or economic deterioration, which could pressure volumes and margins," a press release said. "However, Fitch's baseline scenario anticipates manageable headwinds and continued stability in ratings for the sector in 2026."

The Federal Housing Finance Agency's Title Acceptance Pilot — introduced by the Biden Administration and expanded by current director Bill Pulte — will not affect the sector's ratings

On Dec. 3, Keefe, Bruyette & Woods held its annual title day, with the four major underwriters.

The tone regarding the industry's regulation from the four companies — Fidelity National Financial, First American, Stewart and Old Republic — was "fairly positive," KBW said, with no incremental updates from the FHFA and Bill Pulte, its director. The title pilot ends in May.

One regulatory cloud on the title business is a 6.2% reduction in rates in Texas, which state regulators will put into effect on March 1 (the rollback was finalized on Dec. 12, 2025).

Regulators have previously pushed for a 10% reduction, which was put on hold by a court injunction.

"FNF had disclosed earlier that the impact of even a 10% premium reduction in Texas would be negligible," the KBW report said.

How commercial real estate sales affect title companies in 2026

Expectations that

In the first nine months of last year, the commercial business was a significant 20% share of premiums.

KBW takes a similar position on the impact of commercial real estate transactions for title insurers this year.

"While the timing of any recovery in the residential purchase market remains uncertain, the title insurance sector should continue to benefit from the strong level of activity in the commercial real estate market, which is expected to continue into 2026 and should provide a bridge to an eventual recovery in the purchase market," the report on the event from Bose George and Frankie Labetti said.