National mortgage lender and servicer Newrez announced it is making a strategic investment into artificial intelligence platform Homevision to create technology capable of addressing all aspects of underwriting.

Through the partnership, the two companies aim to expand Homevision's scope of work beyond its current collateral underwriting focus. Already a client of Homevision, Newrez expects to

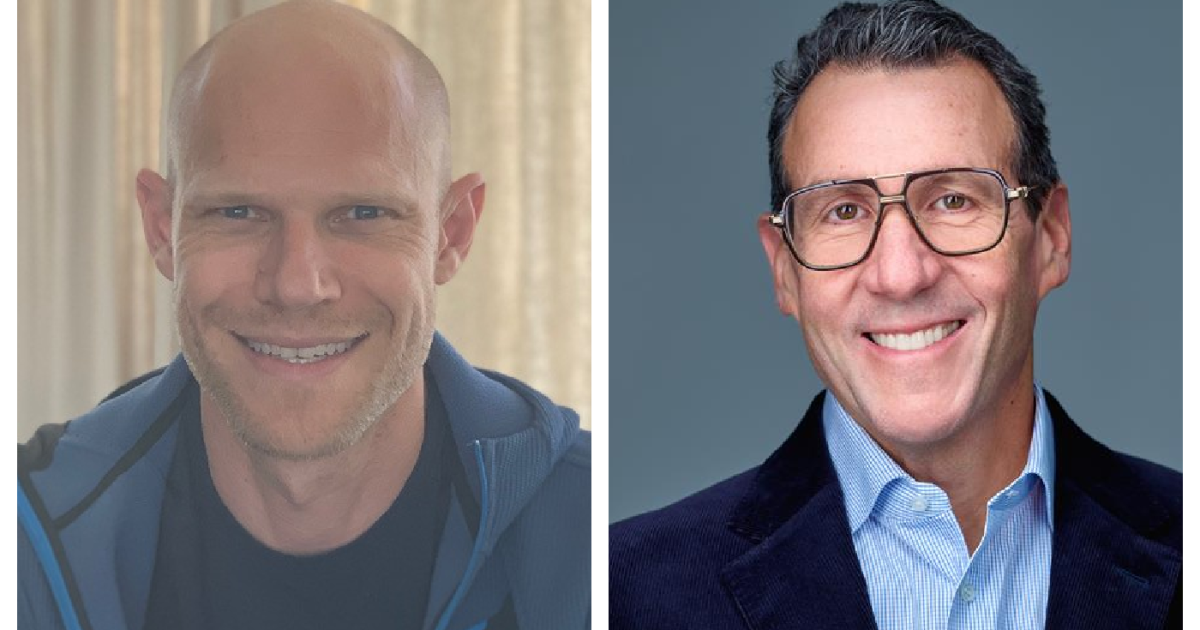

"We are thrilled to deepen our relationship with Newrez as a partner to advance our mission to build the industry's leading AI-enabled underwriting platform," Homevision CEO and co-founder Jeff Foster said in a press release.

"Their investment accelerates our ability to expand beyond collateral review and deliver more intelligent, scalable underwriting solutions across the mortgage origination process," Foster continued.

The

"By combining Newrez's deep mortgage origination expertise with Homevision's cutting-edge machine intelligence, we're accelerating the path to real-time mortgage decisions," said Baron Silverstein, president of the home lender.

Financial terms of the deal were not disclosed.

Growing expectations for AI in 2026

Newrez's deal with the San Francisco-based software firm arrives as several technology experts expect the mortgage industry to see visible benefits from artificial intelligence specifically related to efficient underwriting in the next 12 months. Use of

Innovation that can expedite mortgage closings appears poised to see further financial investments in the new year as well. Along with the Newrez-Homevision announcement this week, the final months of 2025 saw a $22 million Series A capital raise for automation platform Tidalwave, with participants that included homebuilder and lender D.R. Horton. Meanwhile, earlier in 2025, AI-backed underwriting fintech Friday Harbor found itself on the receiving end of a $6 million seed round.

Emerging strategies among mortgage players

Although partnerships and lender investments in technology providers are nothing new, the latest agreement comes as the mortgage industry starts 2026 in a noticeably different business landscape compared to one year ago.

Headline-making acquisitions from Rocket Cos. led several mortgage firms, including lenders, servicers and technology providers, to examine their strategies in 2025 that would put them in a better position to compete against a newly combined corporate giant.

While some of the largest companies, including Rocket's crosstown Detroit rival, United Wholesale Mortgage,

Still, others took a different approach similar to Newrez's latest move, choosing to

The decision to invest in Homevision "underscores Newrez's commitment to redefining the mortgage experience through strategic partnerships that advance innovation and set a new industry standard," Silverstein said.

Prior to the spate of 2025 M&A deals, Rithm Capital had already expanded Newrez's servicing and recapture opportunities less than two years earlier with an acquisition of Computershare Mortgage Services.

The Homevision investment bears resemblance to Mr. Cooper's