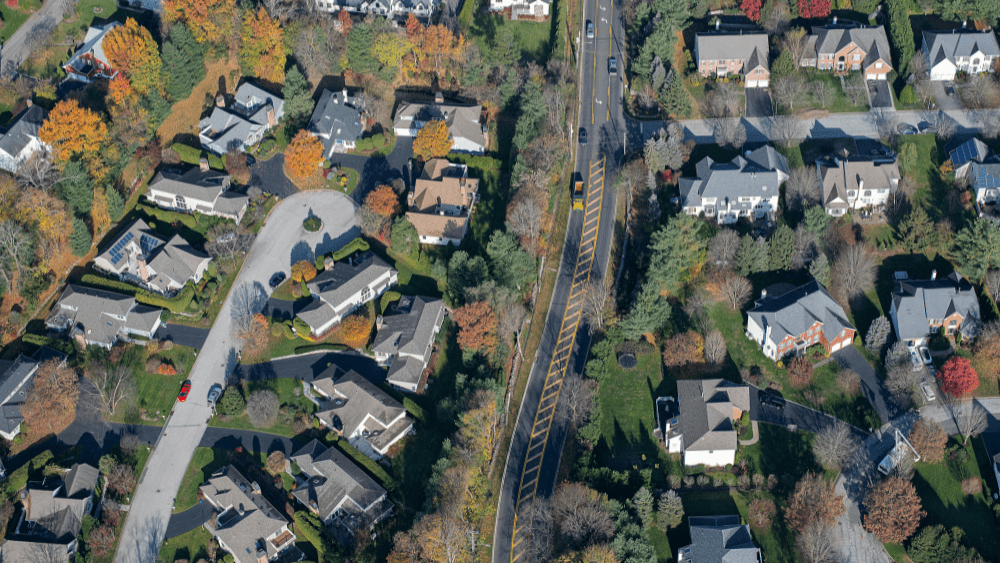

Homeowners associations, or HOAs, are increasing in popularity across the United States. According to HOA-USA, there are nearly 370,000 HOAs in the country, representing 53% of owner-occupied dwellings, or more than 40 million households. HOAs have always been common in condos and townhomes, but more and more single-family neighborhoods are opting to implement HOAs. Although HOAs are popular, many buyers still wonder, “What is an HOA, really?” and what costs and rules they should know. Buyers who don’t understand their HOA might find themselves in a world of hurt after the documents are signed and they realize that they can’t use their home for something they intended to without getting fined. They might also not realize the nuances of HOA dues and find themselves overstretched, budget-wise — definitely not ideal for a new homeowner. Before you buy a home with an HOA, here’s what you need to know.

An HOA is just that: a group (or “association”) of homeowners within a certain type of real estate development — usually a single-family home, condo, or townhome — that establishes and enforces rules and regulations for that development. The association itself comprises a board; members are elected by the residents of the neighborhood. HOAs are also responsible for things like landscaping within the development and maintenance of any shared spaces, such as pools, meeting rooms, gyms, tennis courts, and so on. HOAs charge dues to the residents of their communities on a monthly, quarterly, or annual basis to pay for these benefits. All HOAs are governed by bylaws, which specifically outline the duties and responsibilities of the board: when and where the board will hold meetings; how many seats are on the board; members’ voting rights; how often meetings are conducted and the organization of business during the meetings; and more. Examining an HOA’s bylaws will give you a feel for how the HOA in your neighborhood is run.What is an HOA?