The March 2023 banking crisis will be remembered for

Yet one entity that came under scrutiny

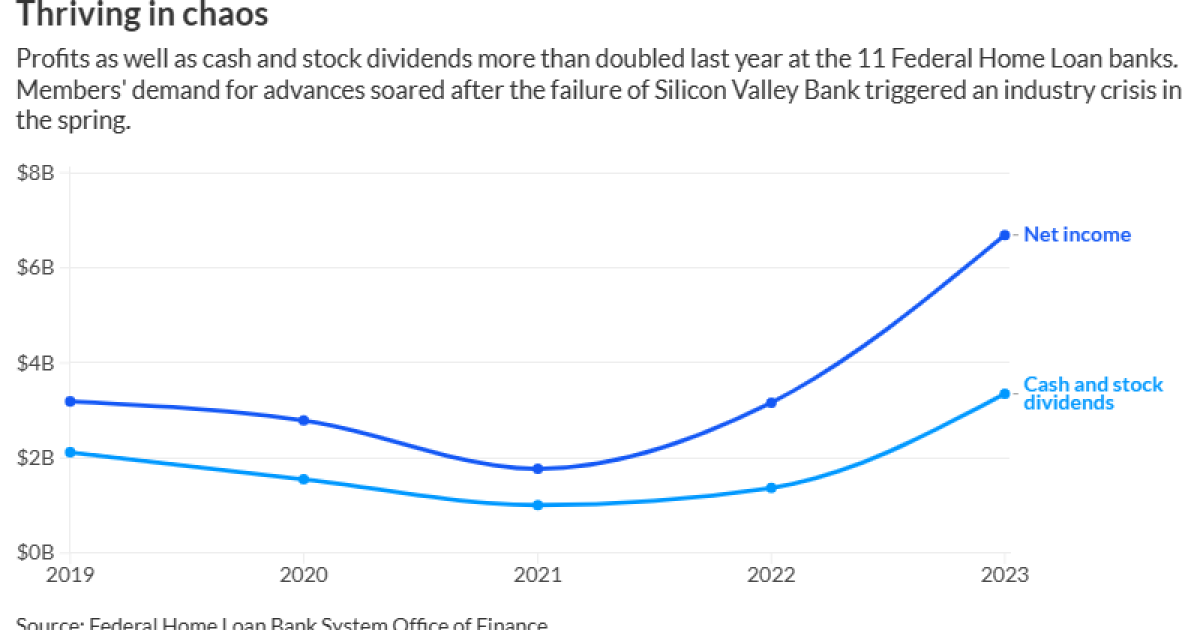

The Federal Home Loan Bank System earned $6.7 billion at year-end, a 111% jump from a year earlier. The system also paid out a record $3.4 billion in dividends to its members, more than double the $1.4 billion paid in 2022.

Critics are pointing to the system's

"Numbers don't lie," said Sharon Cornelissen, director of housing for the Consumer Federation of America, who chairs the nonprofit Coalition for FHLB Reform, a group of academics, housing advocates, regulators and Home Loan bank alumni seeking to reform the 91-year-old system. "The numbers show that the Home Loan banks continue to prioritize the profitability of their members over their mission of promoting affordable housing."

Each of the 11 regional Home Loan banks is required by statute to give 10% of earnings to affordable housing, an assessment that comes to $752 million for 2024. The banks expect to contribute roughly $1 billion toward its Affordable Housing Program and voluntary programs in 2024, a spokesman said. The amount paid to affordable housing rises and falls based on the system's profitability.

"Dividends are reflective not only of the extent to which members rely on the liquidity we provide, which expands and contracts based on member needs; they represent a return on investment that our members pour back into housing finance and other financial services for their local communities," Ryan Donovan, president and CEO of the Council of Federal Home Loan Banks, said in a statement.

The collapses of Silicon Valley Bank, Signature Bank, First Republic Bank and Silvergate Bank called into question the dual role of the Home Loan banks in providing liquidity to their members while also supporting housing. The Federal Housing Finance Agency, the system's regulator, was already conducting a

Many experts are waiting for the FHFA to make its next move toward reforms by releasing an expected rule that would define the system's mission, which has become the subject of much debate.

In November, the FHFA

Dividends have received renewed focus after the Yale School of Management's Program on Financial Stability

Steven Kelly, an associate director of research at Yale's Program on Financial Stability, said the Home Loan banks' dividend practices should be better aligned with the system's housing goals.

The Home Loan banks have a unique structure of both membership and activity-based stock. Members are required to hold nominal amounts of stock but when a bank member taps the system for advances, the loan is used to purchase additional stock, typically 4% to 5% of the loan amount.

"The dividends reward process would be an easy prong to refocus on affordable housing," Kelly said.

In the past year, the Federal Home Loan Bank of New York

"Most [Home Loan banks] pay a much higher dividend on activity stock because they want to encourage members to borrow more," said Peter Knight, a former director of government relations for nearly 20 years at the Federal Home Loan Bank of Pittsburgh, who is also a member of the Coalition for FHLB Reform.

There is little public data on the interest rates the Home Loan banks charge and whether the rates on advances are comparable to — or cheaper than — borrowing from the Federal Reserve's discount window, which has become an issue in the larger debate about reforming the system.

Knight noted that in February, the Federal Home Loan Bank of Chicago touted its higher dividends for helping its members lower their borrowing costs.

"The net benefit of the higher dividend received on Class B1 activity stock has the effect of lowering your borrowing costs from us," the Chicago bank said in a

The Home Loan banks are a government-sponsored enterprise whose debt receives an implicit government guarantee. Some critics say that more of the system's profits should go toward its housing mission because the banks receive cheap funding from the implied guarantee that the government would step in in the event of a default.

"The FHLBs are getting this advantage by being able to issue debt that is treated as government debt, and then go out and do risky things with it," said Kelly. "To transform something that's risky, namely lending to banks on the asset side, into something that's risk-free, namely government-backed liabilities on the liability side, is a significant advantage."

The system says that any effort to change dividends would have an impact on the ability of community banks to tap the system's low-cost funding to make payroll, smooth out earnings and stay in business.

"Without these dividends — which is the only return on the capital paid in by our members — many local community lenders would not be able to provide mortgages and small-business loans in thousands of communities across the country," Donovan said.