Bipartisan lawmakers Thursday called on the Biden Administration’s task force on combating home appraisal bias to release more data backing its proposed reforms, and to expand its scope.

The White House this week unveiled proposals from its Property Assessment and Valuation Equity Task Force to address appraisal bias negatively impacting Black and Latino homeowners, which was revealed in recent Fannie Mae and Freddie Mac studies. Changes include anti-bias and fair lending training for appraisers under federal programs; assistance for states to diversify the profession; and incoming rules to eliminate bias in algorithms.

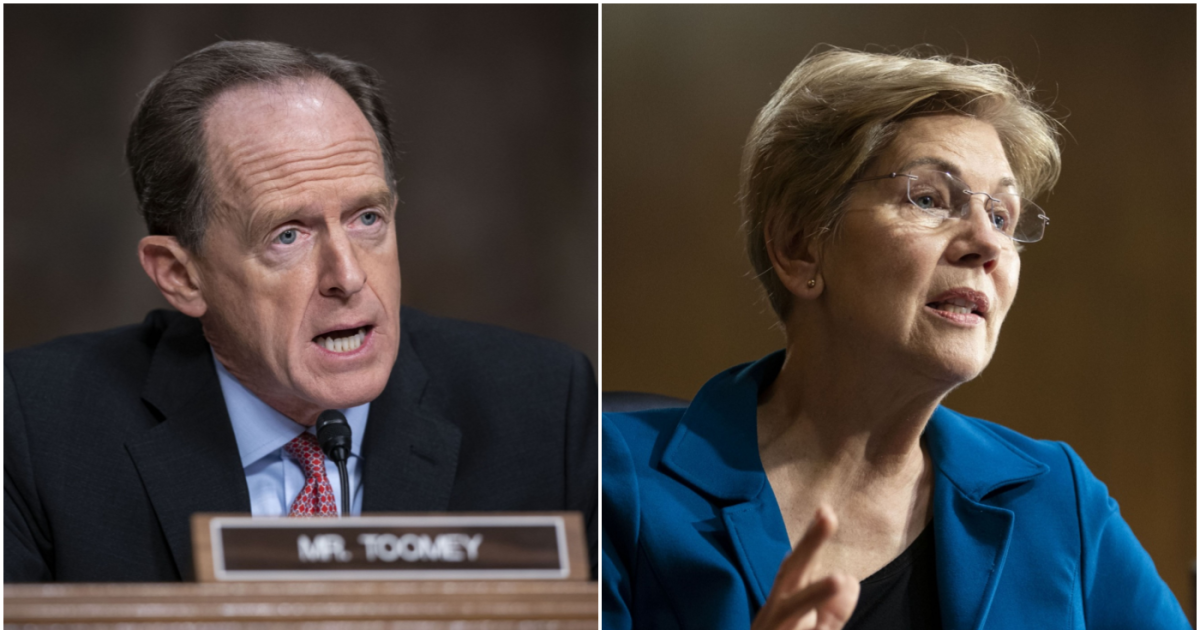

Pennsylvania Sen. Pat Toomey took aim at PAVE’s proposals during Thursday’s U.S. Senate Committee on Banking, Housing and Urban Affairs, acknowledging “terrible” anecdotes of appraisal bias but questioning the government-sponsored entities’ data backing the proposals.

“These reforms would increase the cost of the appraisal process and that means homeowners and homebuyers would have to pay that if we’re going to do that,” said Toomey, the committee’s top Republican. “I think that should be based on reliable data.”

Toomey pointed to the GSE reports that stopped short of explicitly blaming appraisal gaps on racial discrimination, although both studies suggested it as a driver. He also took aim at the proprietary nature of the GSE’s findings and suggested a peer review. Melody Taylor, executive director for PAVE, told Toomey the task force would work on making the data publicly available.

Four Democratic senators on the committee agreed with Toomey’s request for more publicly available data but did not dispute the GSE findings. New Jersey Senator Robert Melendez, in recounting various data pointing to the overwhelming percentage of white appraisers in the industry, gave Freddie Mac’s research a nod.

“I understand maybe why some of the appraisals are skewed,” he said. “Not because I said it, but because Freddie Mac said it. I don’t think Freddie Mac is a flaming liberal organization.”

Fannie Mae and Freddie Mac’s regulator, the Federal Housing Finance Agency, separately published research in December analyzing millions of appraisals and found evidence of valuation bias in the “neighborhood description” section of the valuation reports, including some explicit references to race and indirect comments alluding to it.

Officials during the hearing agreed to include Veterans Affairs and U.S. Department of Agriculture representation on the Appraisal Subcommittee of the Federal Financial Institutions Examination Council, part of PAVE’s makeup. The impact of the shrinking appraiser pipeline is difficult for rural communities, which are also even more challenged by the lack of supervisors to train incoming professionals, Montana Sen. Jon Tester, a Democrat, said.

James Park, executive director of the Appraisal Subcommittee also acknowledged that PAVE doesn’t address manufactured homes, a shortcoming he promised to address in response to a question from Democratic Nevada Sen. Catherine Cortez Masto.

“There's a whole market out there of manufactured homes that we should also be pulling into the housing market to put a roof over people's heads and give them opportunities and it's not even included,” Cortez Masto said.

Park also suggested markets both rural and nonhomogeneous are negatively impacted by appraisal algorithms because of less reliable data, echoing arguments from the Consumer Financial Protection Bureau on artificial intelligence. The automated valuation models are one of PAVE’s biggest targets, and Vice President Kamala Harris Wednesday said new rules would be passed to address the algorithms, although officials haven’t elaborated publicly on what they could entail.

Massachusetts Senator and Democrat Elizabeth Warren spoke at length about the impact of underlying data that reflected past racial discrimination.

“Too often, these algorithms are just a black box with little visibility into the data and the modeling that are going on inside,” Warren said. “And if the underlying data itself reflects past racial discrimination, AVMs may end up compounding disparities in valuation rather than reducing them.”