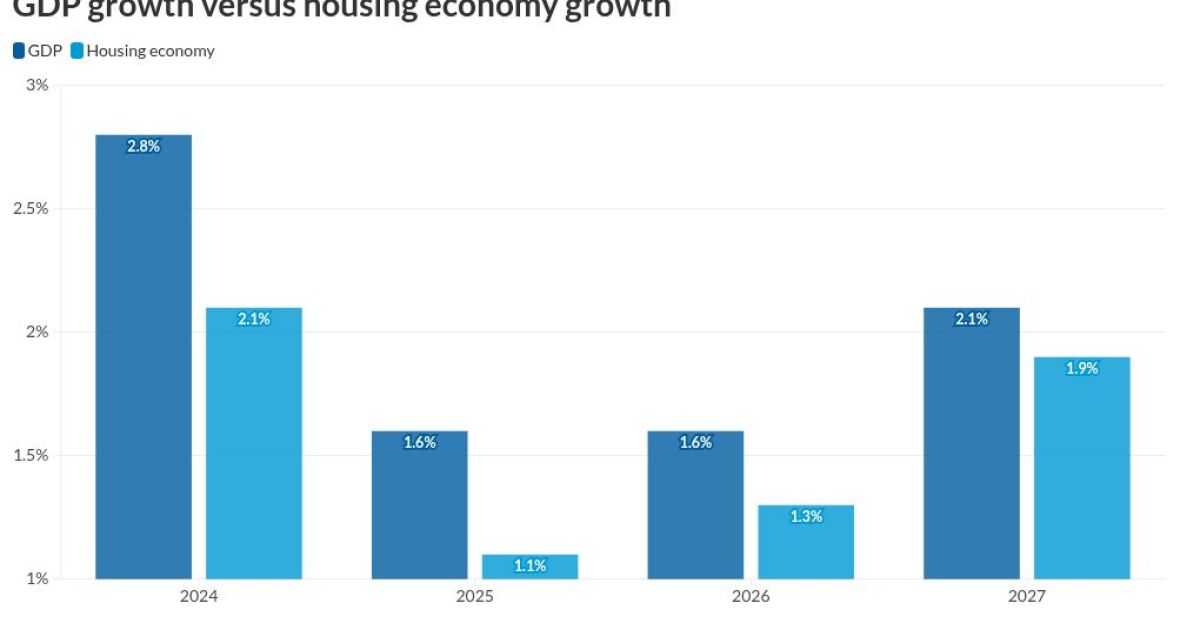

The U.S. residential housing economy growth will have slowed by 1.1% this year, from 2% in 2024, a result of cost pressures derived from higher tariffs on builder supplies like lumber, labor issues and weaker consumer and homebuilder sentiment about the sector, Fitch Ratings said.

Over the next two years, it expects restrained growth rates of 1.3% in 2026 and 1.9% in 2027.

While supply remains tight, Fitch's U.S. Cross-Sector Housing Monitor found demand indicators to be weakening.

"New home inventory has declined slightly, while existing home inventory continues to improve, helped by declining mortgage rates that should spur turnover and demand," a Fitch press release said. "Fitch expects

The Mortgage Bankers Association's Weekly Application Survey for the week ended Nov. 7 had the conforming 30-year fixed-rate mortgage averaging 6.34%. The 10-year Treasury yield closed that day at 4.09%, making the spread 225 basis points, higher than the 180 basis point norm. The current level is still better than the 245 basis point spread in April.

In an effort to improve affordability, the Trump Administration floated the ideas of

Predictions of home price growth

Fitch believes home price growth in 2026 will be flat, following an annual increase of 1.5% this year and 4% for 2024, with affordability and local supply gluts having the biggest impact. Regional variations will play a role; high inventory in the South will hold prices down but low supply in the Northeast will cause values to rise.

Fitch forecasts single-family starts to fall 5.5% this year, compared with 6.8% growth in 2024, while multifamily should rise by 13%; this is up from a 25.1% decline last year.

Its outlook for new home sales this year is for a 3% decline.

"Homebuilders

When it comes to tariffs, Canada and Mexico represent 25% and 10% of total construction-related imports respectively, the report noted.

KBRA's view of the housing market

The analysts at Kroll Bond Rating Agency are more conservative than Fitch's when it comes to the rate outlook. It expects rates to remain in the 6% to 6.5% range "as inflation remains sticky and unemployment edges higher."

But it agrees home prices will remain flat when looked at nationwide but with wide regional differences.

Another theme for the industry to watch next year is for state-level regulatory activity to rise amid "slow federal reform."

What will next year's PLS activity end at

Private-label

For what it termed "esoteric RMBS issuance," this category of reverse mortgage, residential transition loans and home equity investment products should grow 7% in volume. RTL alone should increase 32%, countering an 8% drop in reverse mortgage securitization activity.

In a section of the report titled "regulatory uncertainties," KBRA notes while the government-sponsored enterprise reform narrative out of the Trump Administration continues, no timeline exists for

Outlook at both KBRA and Fitch for delinquency rates

KBRA expects delinquencies to continue to rise next year, particularly in nonprime securitization, but the overall RMBS market is "well positioned" to handle the increase.

The nonprime 90 day or more delinquency rate is elevated but has stabilized this year.

"With

Fitch pointed out residential mortgage and home equity line of credit

The rating agency "expects the performance of its rated RMBS portfolio to weaken further as rising inflation and lower real household income challenge borrowers. Stretched affordability and higher debt-to-income ratios will lift the serious delinquency rate to 1.7% in 2026 from 1.4% in 2025."