Mortgage credit availability started loosening up in March, indicating lenders are willing to take on borrowers lower on the qualification spectrum as the economy rebounds.

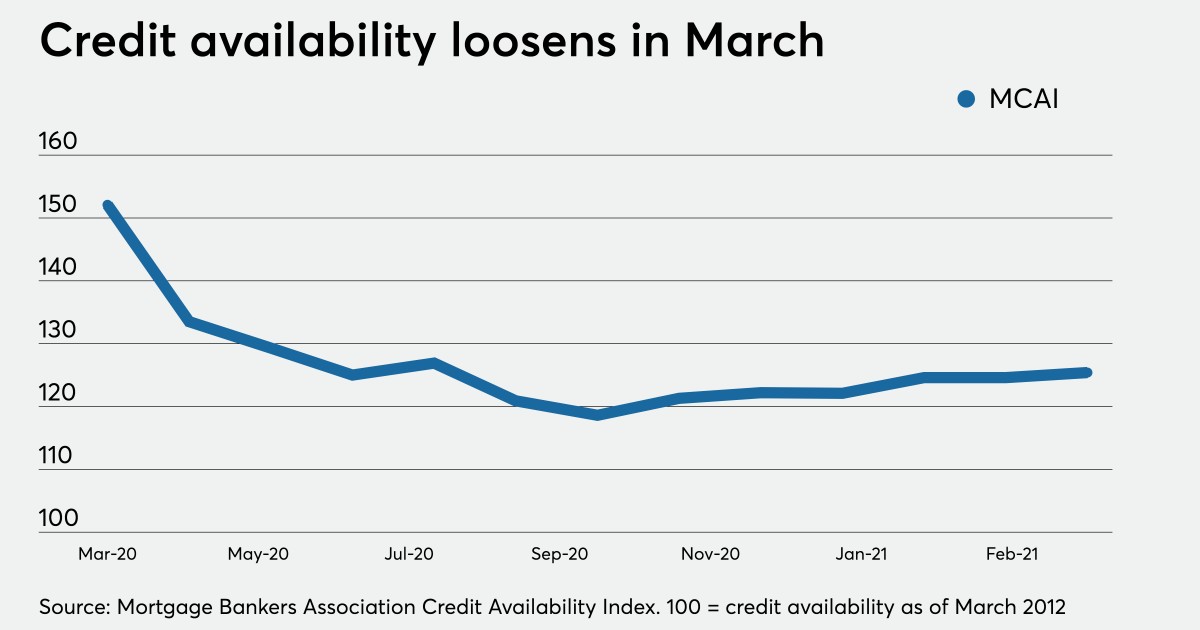

The Mortgage Bankers Association's Mortgage Credit Availability Index expanded by 0.6% to 125.4 in March after it plateaued in February at 124.6. The number remains a far cry from the year-ago level of 152.1, even after the index plummeted to a five-year low once the coronavirus lockdowns took hold and lenders became more risk-averse. Since March 2020, the overall MCAI hovered at levels not seen since 2014.

Recent interest rate growth and an extreme shortage in housing supply constrained mortgage activity during the time of year when it normally starts ramping up. Though slight, March’s extension of credit offerings could signal lender recognition of these increasingly unfavorable market conditions for borrowers. It also reflects a recovering job market and the impact of multiple stimulus checks, raising the amount of low credit score and high loan-to-value products underwritten.

"As we look ahead to the expected growth in the purchase market, which will be driven by millennials and first-time home buyers, credit availability to qualified borrowers will play an important role in supporting this demand," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

Every market segment increased on a monthly basis in March. The conventional index grew 0.8% from February and the conforming component was up 0.2%. The government MCAI — inclusive of Federal Housing Administration, Veterans Affairs and Rural Housing Service loans — grew for the sixth time in the past seven months, rising 0.4% to its highest level in a year.

The jumbo index led all growth with a 1.5% monthly jump, marking the sixth straight month of expanded jumbo credit supply. This resulted from the Consumer Financial Protection Bureau's revisions to the Qualified Mortgage and Ability-to-Repay rules and 2020’s skyrocketed home prices, a reversal from the pandemic’s onset, Kan added.